Bitcoin just did something big. It broke through the $120,000 “cap,” and one big reason: Crypto Week in the United States. If you’ve been either watching the numbers, scratching your head or just plain wondering what’s behind the skyrocketing of cryptos — this is your quick, all-in-one explainer.

Let’s unpack what is happening, why it matters and how it could remake the crypto world as we know it.

🚀 What Goes Down During the US’s “Crypto Week”? Why Should You Care?

The US House of Representatives kicked off consideration of three possibly market-moving crypto bills on July 14. Together, they hope to provide the clarity and stability that investors and cryptocurrency startups have been demanding for years in the digital asset space.

These bills are:

GENIUS Act: Classifies whether or not tokens are securities or commodities — this has the potential to eliminate the gray area that has been hanging over the head of both startups and exchanges.

Clarity Act: Prevents federal agencies from exceeding scope of dated regulations. Translation? More power to Congress, less disorder.

4) Anti-CBDC Surveillance State Act: Bans a government-issued digital currency. Score one for privacy advocates.

Crypto insiders are hailing the moment as the most significant one in digital asset history.

💸 Why Is Bitcoin Surging?

The latest Bitcoin surge above $122,000 is more than a price spike.Its a vote of confidence. Here’s why investors are rushing in:

Regulatory hope: If the rules are clear = more institutional money. Wall Street has been champing at the bit.

Political support: President Donald Trump, who previously was skeptical, is now the “Crypto President.” He’s already taken campaign funds in crypto and supports meme coins like $Trump and $Melania.

Market sentiment: Traders are betting these bills could at last open the floodgates for innovation and adoption.

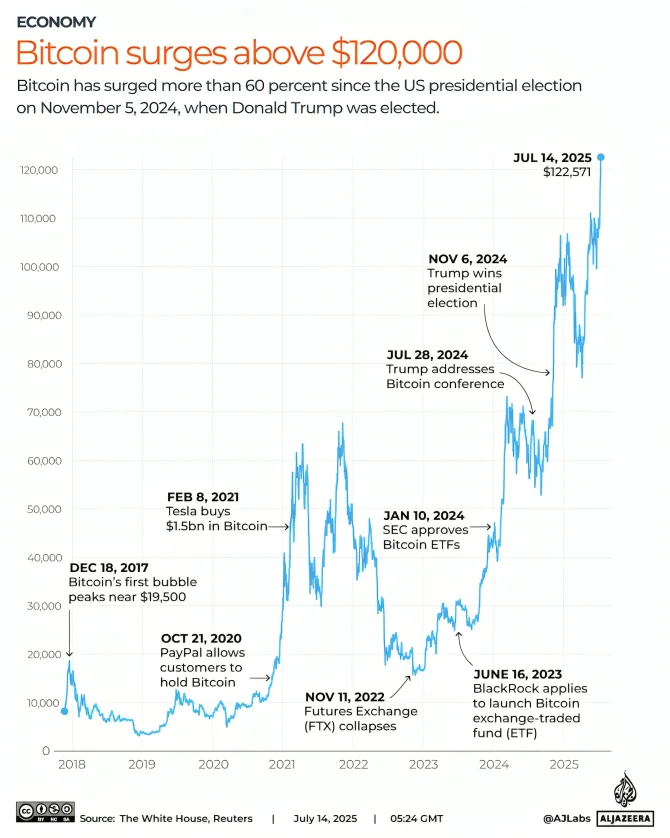

The numbers speak for themselves: Bitcoin is up 29% year-to-date. Since Trump’s re-election, it’s up and staggering 75%.

📈 Real-World Impact: What This Means for the Market

Bitcoin’s momentum is contagious. Ethereum (ETH) hits a five-month high of $3,048, smaller altcoins are going in the same direction. The total market cap of the entire crypto market is now $3.78 trillion, according to CoinMarketCap.

And it’s not only charts and graphs — people are experiencing it:

“We anticipate that investment that has been on the sidelines, awaiting reaction to the recent regulatory news, will likely re-enter the market.

In other words: crypto is getting investable again — at least for those with the wherewithal to tolerate a risky asset class for potential outsized returns.

👥 But Not Everyone’s Cheering

Republicans have rallied behind the bills, with some Democrats, including Senator Elizabeth Warren, pushing back. She cautions that deregulating could put the nation on a path toward another financial crisis.

Her concerns?

The legislation could undermine investor protections.

Bad actors could take advantage of loopholes.

Any new regulations need to contain money laundering provisions.

As ever in Washington, the fight isn’t finished. But the tide is rapidly turning.

🧠 The Big Picture: Why It Matters

Consider this: Bitcoin was trading at less than half a penny in 2009. Today, it’s crossing $122,000. That’s not just a price increase — it’s a sea change.

We are witnessing a new financial infrastructure emerge, one in which:

You no longer need a bank to make a payment.

You can trade on assets 24 hours a day, wherever you are in the world.

Politics and technology are at last sitting down to dinner together.

In this week’s newsletter, my colleague Nathaniel Popper and I discussed in further detail what people should think about all of this mess, whether they’re a HODLer, a skeptic or simply crypto-curious.

✨ Final Thoughts

Crypto Week in the US isn’t just about Bitcoin price charts or policy jargon: It’s about how we’ll trade, store and think about money going forward. Believe in blockchain or not, one thing is certain: The world of virtual currency is growing up, and the United States is trying to hold a front-row seat.

And maybe, just maybe, all of us are witnessing the making of history.

📌 Frequently Asked Questions About Bitcoin

2025 में $1 बिटकॉइन की कीमत कितनी होगी?

📊 यह भविष्यवाणी करना मुश्किल है, लेकिन कुछ एक्सपर्ट्स का मानना है कि 2025 तक बिटकॉइन की कीमत $100,000 (₹80 लाख से अधिक) तक जा सकती है। लेकिन इसमें जोखिम भी शामिल है।

How much is Bitcoin selling for today?

🔹 The price of Bitcoin keeps changing every minute. As of now, it is approximately ₹50–60 lakhs per Bitcoin (based on market trends).

📈 Check real-time rates on trusted crypto platforms like CoinMarketCap or WazirX.

Can I buy 1 Bitcoin in India?

✅ Yes, you can buy 1 Bitcoin in India using crypto exchanges like CoinDCX, WazirX, or Binance. However, you must complete KYC and follow RBI guidelines.

Can I buy Bitcoin for 1000 Rs?

💸 Yes, you don’t have to buy a full Bitcoin. You can invest as little as ₹100 or ₹1000 and buy a fraction of a Bitcoin (called Satoshi).

क्या मैं भारत में 1 बिटकॉइन खरीद सकता हूं?

✅ हाँ, आप भारत में क्रिप्टो एक्सचेंज के माध्यम से 1 बिटकॉइन खरीद सकते हैं जैसे WazirX, CoinDCX, आदि। आपको KYC पूरा करना होगा।